2/4/ · i think that most brokers would have an issue with 0% leverage because they give margin calls at % margin or near there. that would mean if you used all of your margin you would be below that level instantly 31/7/ · Best leverage in forex trading depends on the capital owned by the trader. It is agreed that to is the best forex leverage ratio. Leverage of means that with $ in the account, the trader has $50, of credit funds provided by the broker to open trades. So leverage is the best leverage to be used in forex blogger.comted Reading Time: 8 mins 8/2/ · x $10 =$1 Leverage = trade size / equity. $10 / $1 = 10 times or The example highlights the basics of how forex leverage is used when entering a blogger.comted Reading Time: 4 mins

What is Leverage in Forex? Forex Leverage Explained

We use a range of cookies to give you the best possible browsing experience, 0 leverage forex. By continuing to use this 0 leverage forex, you agree to our use of cookies, 0 leverage forex. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site.

See our updated Privacy Policy here. Note: Low and High figures are for the trading day. Many people are attracted to forex trading due to the amount of leverage that brokers provide. Leverage allows 0 leverage forex to gain more exposure in financial markets than what they are required to pay for.

Traders of all levels should have a solid grasp of what forex leverage is and how to use it responsibly. This article explains forex leverage in depth, including how it differs to leverage in stocks, and the importance of risk management. Leverage in forex is a useful financial tool that allows traders to increase their market exposure beyond the initial investment deposit.

However, it is essential to know that gains AND losses are magnified with the use of leverage. In adverse market scenarios, a trader using leverage might even lose more money than they have as deposit. The amount of forex leverage available to traders is usually made available through your broker and the amount of leverage will vary according to regulatory standards that preside in different regions.

Forex leverage differs to the amount of leverage that is offered when trading shares. This is 0 leverage forex to the fact that the major FX pairs are liquid and typically exhibit less volatility than even the most frequently traded shares. Brokers often provide traders with a margin percentage to calculate the minimum equity needed to fund the trade. Margin and deposit can be used interchangeably. Once you have the margin percentage, 0 leverage forex, simply multiply this with the trade size to find the amount of equity needed to place the trade.

The example highlights the basics of how forex leverage is used when entering a trade. However, it must be noted that traders should not simply calculate the minimum amount needed to enter a trade and then fund the account with that exact amount.

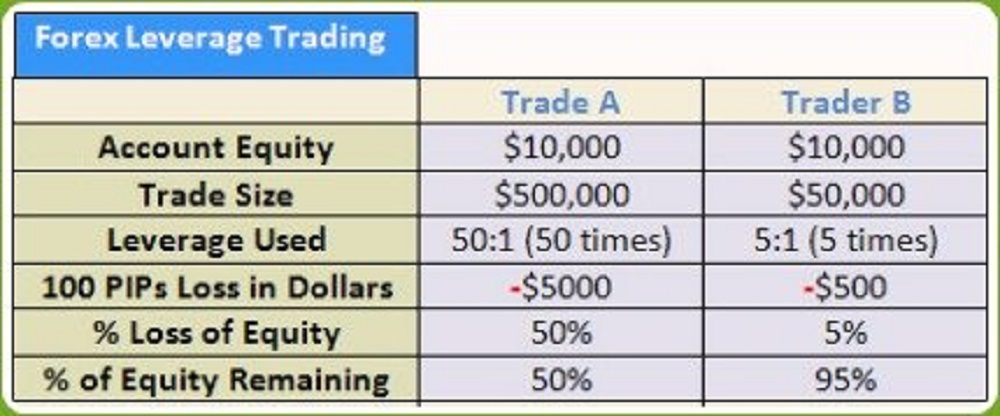

Traders must be mindful of margin calls if the position moves in the opposite direction, bringing the account equity below an acceptable level determined by the broker. Trading forex with leverage has the potential to produce large losses. We have calculated a typical scenario of how the use of excessive leverage can impact a trading account and tabulated the 0 leverage forex. Leverage can be described as a two-edged sword, 0 leverage forex, providing both positive and negative outcomes for forex traders.

This is why it is essential to determine the appropriate effective leverage and incorporate sound risk management. Top traders make use of stops to limit their downside risk when trading forex, 0 leverage forex.

Furthermore, successful traders 0 leverage forex use of a positive risk-to-reward ratio in an attempt to achieve higher probability trades over time. It is vital to avoid mistakes with leverage; to understand how to avoid other issues traders might face check our Top Trading Lessons guide. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances.

Forex trading involves risk. Losses can exceed deposits. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. FX Publications Inc dba DailyFX is registered with the Commodities Futures Trading Commission as a Guaranteed 0 leverage forex Broker and is a member of the National Futures Association ID Registered Address: 32 Old Slip, Suite ; New York, NY FX Publications Inc is a subsidiary of IG US Holdings, Inc a company registered in Delaware under number Sign up now to get the information you need!

Receive the best-curated content by our editors for the week ahead. By pressing 'Subscribe' you consent to receive newsletters which may contain promotional content.

For more info on how we might use your data, see our privacy notice and access policy and privacy website. Check your email for further instructions. Live Webinar Live Webinar Events 0. Economic Calendar Economic Calendar Events 0, 0 leverage forex.

Duration: min. P: R:. Search Clear Search results. No entries matching your query were found. English Français 中文(繁體) 中文(简体). Free Trading Guides, 0 leverage forex. Please try again. Subscribe to Our Newsletter. Market Overview Real-Time News Forecasts Market Outlook 0 leverage forex News Headlines. Rates Live Chart Asset classes. Currency 0 leverage forex Find out more about the major currency pairs and what 0 leverage forex price movements.

Commodities Our guide explores the most traded commodities worldwide and how to start trading them, 0 leverage forex.

Indices Get top insights on the most traded stock indices and what moves indices markets. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Economic Calendar Central Bank Calendar Economic Calendar. Fed Bowman Speech. ECB Panetta Speech. Fed Bostic Speech. Trading courses Forex for Beginners Forex Trading Basics Learn Technical Analysis Volatility Free Trading Guides Live Webinars Trading Research Trading Guides.

Company Authors Contact. of clients are net long. of clients are net short. Long Short. News EURUSD and USDJPY Staged for Breaks as Fed Calculus Shifts, US Debt Limit Looms Oil - US Crude. News Brent Crude Oil Soars to a Three Year High on Supply-Demand Mis-Match Crude Oil Outlook: WTI Prices Climb, Supply Constraints Support Higher Prices Wall Street. News Dow Jones Gains as Nasdaq Sinks, Crude Oil Boosts Energy Stocks.

ASX in Focus Gold and Silver Price Outlook Bleak: Sellers in Control as US Bond Yields Rally News US Dollar, Japanese Yen May Rise if Fed Policy Destabilizes CLO Market EURUSD and USDJPY Staged for Breaks 0 leverage forex Fed Calculus Shifts, US Debt Limit Looms More View more.

Previous Article Next Article. What is Leverage in Forex? Forex Leverage Explained Richard SnowAnalyst. What is leverage 0 leverage forex forex trading? Leverage is usually expressed as a ratio: Leverage expressed in words Leverage expressed as a ratio Ten-to-one Thirty-to-one Fifty-to-one The amount of forex leverage available to traders is usually made available through your broker and the amount of leverage will vary according to regulatory standards that preside in different regions.

Leverage in forex vs leverage in shares Forex leverage differs to the amount of leverage that is 0 leverage forex when trading shares. How is forex leverage calculated? Traders require the following to calculate leverage: The notional value of the trade trade size The margin percentage Brokers often provide traders with a margin percentage to calculate the minimum equity needed to fund the trade.

How to manage forex leverage risk Leverage can be described as a two-edged sword, providing both positive and negative outcomes for forex traders. Leverage 0 leverage forex tips If you are new to forex be sure to get up to 0 leverage forex with the basics of forex trading through our New to FX guide. It is highly recommended to make use of stops when trading with leverage. Guaranteed stops eliminate the risk of negative slippage when markets are extremely volatile. Keep leverage to a minimum.

Understand the margin policy of the forex broker to avoid margin call. Foundational Trading Knowledge 1. Forex for Beginners, 0 leverage forex. Forex Trading Basics. Why Trade Forex? Macro Fundamentals. Forex Fundamental Analysis. Find Your Trading Style.

Forex Leverage for Beginners Explained (lot sizes and pips)

, time: 7:17How Leverage Works in the Forex Market

8/2/ · x $10 =$1 Leverage = trade size / equity. $10 / $1 = 10 times or The example highlights the basics of how forex leverage is used when entering a blogger.comted Reading Time: 4 mins 2/4/ · i think that most brokers would have an issue with 0% leverage because they give margin calls at % margin or near there. that would mean if you used all of your margin you would be below that level instantly 31/7/ · Best leverage in forex trading depends on the capital owned by the trader. It is agreed that to is the best forex leverage ratio. Leverage of means that with $ in the account, the trader has $50, of credit funds provided by the broker to open trades. So leverage is the best leverage to be used in forex blogger.comted Reading Time: 8 mins

No comments:

Post a Comment