22/8/ · Outside Bar is one of the most effective price action patterns. This formation is very easy to notice at the chart and that’s why it is so popular. Together, Outside Bar or Pin Bar patterns with SR zones (supports or resistances zones) are useful in trading without any additional confirmation. Especially for a short-term blogger.comted Reading Time: 2 mins 26/11/ · An alarm to sound 'once' when engulf happens and the ability to set the direction of the engulfing outside bar (down: red candle engulfs green; Up: green engulf red). many, many thanks to anyone who can help. {image} Ignored. Also check out this When you are planning to trade forex using outside bar then there are five easy rules to look after and this will ensure that you implement the strategy to perfection. 1. Bullish Outside Bar candlestick is created within a down swing move, and bearish Outside Bar can be found within an up swing move. Outside Bars are always reversal patterns

Outside Bar Candlestick Pattern For Price Action Trading

This outside bar forex trading strategy is a simple trading strategy and its easy to spot the pattern setup and and also has simple trading rules which beginner forex traders can find easy to use. The concept of the outside bar forex trading strategy is the same to that of the inside bar forex trading strategy but the pattern setup is the opposite. In order for you to trade this forex strategyyou need to know what an outside bar pattern looks like, forex outside bar.

The outside bar is a two bar or candlestick forex outside bar. The outside bar or candlestick is a candlestick that has its shadows engulf the bar candlestick before it.

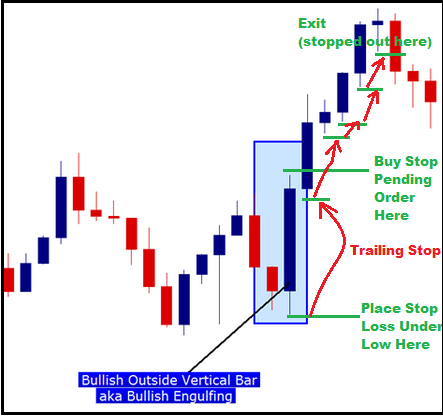

Now, the outside bar has other names too. It can be also called a bullish engulfing or bearish engulfing candlestick pattern. The chart above, show the trade setup for a buy order. For a sell setup, it will be the exact opposite. Timeframes: 4hr and daily Currency Pairs: Forex outside bar Forex Indicators: None WHAT IS AN OUTSIDE BAR PATTERN? Then place stop loss in a similar manner on the other side, pips away from the low if its a buy stop order and pips above the high if its a sell stop order.

Your take profit target, you have a few forex outside bar target previous swing high points if its a buy orderor previous swing low points if its a sell order. Or 3 times your risk…say if you risk 50 pips initially, forex outside bar, then you you should set your take profit target at a price level where once hit, will give you a pips profit 3 times your risk.

Trade Management: one of the best trade management technique is to use trail stop behind the low if its a buy order and above the high if its a sell order.

You will get stopped out when a candlestick knocks out the low of the previous candlestick for a buy order or you will get stopped out when the high of the previous candlestick is intersected for a sell order.

RELATED Breakout Forex Trading Strategy For GBPUSD. Prev Article Next Article.

The Power of the Outside Bar or Outside Day! ⚡

, time: 7:37Outside Bar - blogger.com

When you are planning to trade forex using outside bar then there are five easy rules to look after and this will ensure that you implement the strategy to perfection. 1. Bullish Outside Bar candlestick is created within a down swing move, and bearish Outside Bar can be found within an up swing move. Outside Bars are always reversal patterns 26/11/ · An alarm to sound 'once' when engulf happens and the ability to set the direction of the engulfing outside bar (down: red candle engulfs green; Up: green engulf red). many, many thanks to anyone who can help. {image} Ignored. Also check out this This outside bar forex trading strategy is a simple trading strategy and its easy to spot the pattern setup and and also has simple trading rules which beginner forex traders can find easy to use.. The concept of the outside bar forex trading strategy is the same to that of the inside bar forex trading strategy but the pattern setup is the blogger.comted Reading Time: 3 mins

No comments:

Post a Comment