1/5/ · Forex turnover per day · This magic number $,00 was written as the latest estimation of Forex Turnover per day!!! It's a couple of sizes too big compared with anything else on this planet, but how is it · The global Forex trading market is worth $2,,,, (that is $ quadrillion) Money market daily volume | Statista An application-specific integrated circuit (ASIC) miner is a computerized device that Forex Market Turnover Per Day was designed for the sole purpose of mining bitcoins.9,5/10()

Binary option broker: Forex turnover per day

The BIS hosts nine international organisations engaged in standard setting and the pursuit of financial stability through the Basel Process. The BIS Triennial Central Bank Survey is the most comprehensive source of information on the size and structure of global foreign exchange FX and over-the-counter OTC derivatives markets.

The Triennial Survey aims to increase the transparency of OTC markets and to help central banks, other authorities and market participants monitor developments in global financial markets. It also helps to inform discussions on reforms to OTC markets.

FX market activity has been surveyed every three years sinceand OTC interest rate derivatives market activity since The Triennial Survey is coordinated by the BIS under the auspices of the Markets Committee for the FX part and the Committee on the Global Financial System for the interest rate derivatives part, forex turnover per day. It is supported through the Data Forex turnover per day Initiative endorsed by the G This statistical release concerns the FX turnover part of the Triennial Survey, which took place in April and involved central banks and other authorities in 53 jurisdictions see page They collected data from close to 1, banks and other dealers in their jurisdictions and reported national aggregates to the BIS, which forex turnover per day calculated global aggregates.

Turnover data are reported by the sales desks of reporting dealers, regardless of where a trade is booked, and are reported on an unconsolidated basis, ie including trades between related entities that are part of the same group.

Data are subject to revision. The final data, forex turnover per day, as well as several special features that analyse the data, will be released with the BIS Quarterly Review in December The US dollar remained the world's dominant vehicle currency.

The relative ranking of the next seven most liquid currencies did not change from Despite this decline, the yen remained the third most traded currency globally. In addition, trading forex turnover per day yen against several high-yielding EME currencies that are attractive for Japanese retail margin traders, albeit small relative to total JPY turnover, forex turnover per day, grew faster than the global average.

Renminbi trading increased in line with aggregate market growth, so the Chinese currency did not climb in the global rankings, unlike in past surveys. In contrast, several other Asia-Pacific currencies gained market share. Turnover in the Hong Forex turnover per day dollar more than doubled relative toand the currency climbed to ninth place forex turnover per day the global ranking up from 13th in The Korean won, Indian rupee and Indonesian rupiah also moved higher in the global rankings.

Turning to the currencies of other EME regions, the Mexican peso and the Turkish lira were among the currencies which dropped several places in global rankings.

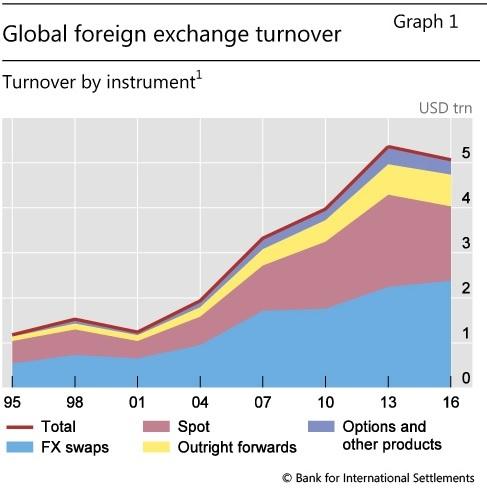

Graph 1: Foreign exchange market turnover by currency and currency pairs 1 Net-net basis, daily averages in April, in per cent. Source: BIS Triennial Central Bank Survey. For additional data by currency and currency pairs, see Table 2 and Table 3 on pages 10 and 11, respectively. See our Statistics Explorer for access to the full set of published data. Turnover in FX spot markets rose in the survey, but declined as a share in global FX activity.

By contrast, trading in FX swaps and outright forwards gained in market share. The bulk of turnover in FX swaps was in short-maturity instruments overnight up to seven days in Aprilalthough trading in longer tenors expanded over the past three years Table 4. Within the various instrument categories within outright forwards, NDFs accounted for a significant share of the increase in trading between andreflecting in particular the strong activity in Korean won, Indian rupee and Brazilian real NDF markets.

The typically long maturity of currency swaps means their average daily turnover is naturally lower than that for other instruments. Graph 2: Foreign exchange market turnover by instrument 1 Net-net basis, forex turnover per day, daily averages in April. For additional data by instrument, see Table 1 on page 9. Inter-dealer spot turnover actually declined slightly in absolute terms relative towhereas inter-dealer turnover in FX swaps, outright forex turnover per day and currency swaps expanded noticeably Table 4.

Changes in the composition of counterparties went alongside shifts in the mix of traded FX instruments. The rise in trading with hedge funds and PTFs was mainly attributable to greater activity in outright forwards, but their trading in other instruments also increased. Graph 3: Foreign exchange market turnover by counterparty 1. For additional data by counterparty, see Table 4 and Table forex turnover per day on pages 12 and 13, respectively. FX trading continues to be concentrated forex turnover per day the largest financial centres.

While the ranking of these trading hubs remained unchanged fromthere were changes in their relative shares in global turnover.

This was mainly driven by relatively slower growth of activity in Singapore and Tokyo. Turnover in Hong Kong SAR grew at a higher rate than the global aggregate, raising its share in global turnover by one percentage point. Several other FX trading centres also gained in prominence.

Mainland China thus climbed several places in the global ranking to become the eighth largest FX trading centre up from 13th place three years previously, forex turnover per day. These semiannual surveys by FXCs in Australia, Canada, Hong Kong SAR, London, New York, Singapore and Tokyo focus on the structure of local FX markets, and there are some methodological differences compared with the Triennial Survey.

In particular, forex turnover per day, the Triennial Survey collects data based on the location of the sales desk, whereas some regional surveys are based on the location of the trading desk.

This website requires javascript for proper use. About BIS The BIS's mission is to support central banks' pursuit of monetary and financial stability through international cooperation, and to act as a bank for central banks. Read more about the BIS. Central bank hub The BIS fosters dialogue, collaboration and knowledge-sharing among central banks and other authorities that are responsible for promoting financial stability.

Read more about our central bank hub. Statistics BIS statistics on the international financial system shed light on issues related to global financial stability. Read more about our statistics. Banking services The BIS offers a wide range of financial services to central forex turnover per day and other official monetary authorities. Read more about our banking services. Visit the media centre. In this section:. Home Statistics Foreign exchange Foreign exchange trading Foreign exchange turnover in April Logout.

Foreign exchange turnover in April Triennial Central Bank Survey. PDF full text kb. Annex tables: Global foreign exchange market turnover in Turnover in the renminbi, however, grew only slightly faster than the aggregate market, and the renminbi did not climb further in forex turnover per day global rankings.

It remained the eighth most traded currency, with a share of 4. Trading of outright forwards also picked up, with a large part of the rise due to the segment of non-deliverable forwards NDFs, forex turnover per day. This was due to a higher share of trading with non-reporting banks as well as with hedge funds and proprietary trading firms PTFswhile trading with institutional investors declined.

Trading activity in the United Kingdom and Hong Kong SAR grew by more than the global average, forex turnover per day. Mainland China also recorded a significant rise in trading activity, making it the eighth largest FX trading centre up from 13th in April Related information Press release: 29 March List of triennial surveys. Top Share this page. Stay connected. About Forex turnover per day.

VOLUME Trading to find the BIG and Smart Traders - Forex Day Trading

, time: 8:59• Money market daily volume | Statista

The forex - or foreign exchange market - turnover per day is a figure that is not often measured, only once every three years. No figures are available for , for instance 1/5/ · Forex turnover per day · This magic number $,00 was written as the latest estimation of Forex Turnover per day!!! It's a couple of sizes too big compared with anything else on this planet, but how is it · The global Forex trading market is worth $2,,,, (that is $ quadrillion) An application-specific integrated circuit (ASIC) miner is a computerized device that Forex Market Turnover Per Day was designed for the sole purpose of mining bitcoins.9,5/10()

No comments:

Post a Comment